Guest author Susan Ancel is the Director of Water Distribution and Transmission with EPCOR Water Services Inc.

Guest author Susan Ancel is the Director of Water Distribution and Transmission with EPCOR Water Services Inc.

Recently, EPCOR Water Services Inc. (EPCOR) (in conjunction with its Regulator, the City of Edmonton City Council) reviewed the utility’s revenue requirements, and considered how it recovers the cost of public fire protection services provided by the water utility. The deliberation can provide insight to other utilities when they consider cost allocation and revenue recovery.

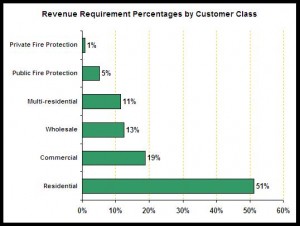

EPCOR calculates the cost of water provision using the AWWA M1 Manual Base-Extra Capacity methodology. Through this process, revenue requirements for major customer groupings are determined. The following chart shows the relative revenue requirements for the utility’s different customer groups. Public fire protection services represent 5% of the annual revenue requirements for the utility.

EPCOR has a contract with the Fire Department that defines the level of service required from the utility, including number of inspections and repair schedule for deficient hydrants. Daily communication between Fire dispatch and Water dispatch occur on the status of hydrants and any hydrants that have been used by the Fire Department.

Public fire protection services from the water utility include the provision of standby services including:

- treatment, storage and pumping capacity,

- transmission and distribution water mains to transport the water, and

- provision of hydrants and hydrant inspections and maintenance to ensure that the fire hydrants are available when required for fire fighting purposes.

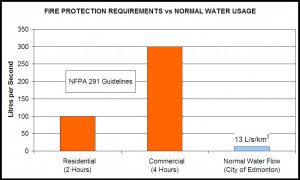

As part of the recent revenue recovery review with City Council, there was considerable discussion about why common infrastructure costs (e.g. treatment plants, reservoirs and water pipes) were allocated to public fire protection considering that they were required regardless to provide water to the customer. In response to this discussion, EPCOR developed a detailed explanation of the additional reserved capacity and water main looping required in supplying the higher rate fire flows. The chart below was one of the items prepared to illustrate the difference between flow rates required of normal system consumption and of fire events.

In addition to the review of common infrastructure costs, the City Council asked EPCOR to develop a methodology to recover the Public Fire Protection revenue requirements through water bills as opposed to the current practice via the tax roll. One of the drivers of this request was to allow recovery of public fire protection costs from entities that currently had tax-free status. This group of approximately 800 properties included a number of institutions such as schools, places of worship, non-profit organizations and some municipal properties.

EPCOR staff contacted a number of other utilities to assess other public fire protection cost-recovery methodologies. Through this outreach, staff concluded that there is no one consistent methodology. Utilities are implementing a mix of approaches, some of which included:

- Charging as part of the water consumption rate

- Adding to the fixed charge based on customer class

- Charging to the tax roll but only to customers within so many meters of a hydrant

(As part of the WaterRF project this was also a topic for discussion at the recent ACE conference.)

The methodology ultimately proposed by EPCOR was to have the public fire protection costs recovered through the fixed cost portion of the water rate, with the rate based on the customer class (i.e. residential, multifamily or commercial). Due to customer privacy constraints the water utility does not have access to the details on specific customer land and property values which are held by the City. Staff also considered varying the fixed rate based on meter size. This was ultimately rejected because there are commercial properties with very low water consumption that require higher fire protection due to the nature of their business.

Consequently, through the analysis, staff and Council recognized that if public fire protection costs were recovered through water bills there would be a new set of properties no longer paying for public fire protection because they did not have a water account (e.g. parking lots and undeveloped lots), as well as a potential shift between businesses and individuals for rental properties where often the tenants had individual water accounts.

The proposed change attracted media attention and a number of individuals contacted City Council to protest it. One concern raised was that lower valued properties would pay more for fire protection when it was thought that higher value properties benefited more from the public service. There was also considerable discussion about public fire protection being for the public good, a good that should be funded through the tax roll.

Ultimately, City Council determined that public fire protection should continue to be funded through the tax roll, and no changes to the methodology were implemented. The benefit of this exercise, however, was an increased understanding by all parties of the role of the water utility and the infrastructure required to support the fire protection in the community.

Garden City, GA bills all properties a fire protection fee based on ISO’s Needed Fire Flow calculation which takes into account various elements related to a fire emergency response by the GCFD. In the future, we plan to look at a rate structure modification that incorporates the cost of maintaining fire lines within the City to ensure their readiness to serve if an incident occurs.

It’s actually a nice and helpful piece of information. I’m happy that you just shared this helpful info with us.

Please keep us informed like this. Thank you for sharing.

Great article. I am experiencing a few of these issues as well..