Jen Weiss is Senior Finance Analyst at the Environmental Finance Center.

There is a small hole in the ceiling leading into the attic of Mr. Smith’s single-family home and the windows are a bit drafty. In the summer, the family’s 15 year old air conditioning unit runs 24 hours a day trying to keep Mr. Smith and his family cool, and in the winter the electric base boards crank out heat to keep them warm. The Smiths try not to keep the temperature in the house too high or too low, but their monthly electricity bills still approach $500 in some months. The family is finding it increasingly difficult to pay their utility bill each month, but unlike cable or telephone service, turning off their electricity is not an option.

The Smith family is, of course, a hypothetical example. Unfortunately, they are an example of a trend that is becoming more frequently found across the Southeast and likely across the nation. Low- to moderate-income families with older homes are finding it difficult to pay their monthly utility bills. As electric rates continue to go up, these homeowners are turning to their utilities for help. Help with ideas on how to reduce energy use, help with weatherization of their homes and help with their utility bills. And many utilities are listening – and making changes.

In South Carolina, 20 electric co-operatives partnered together to pilot a program called Help My House (HMH). The 125 home pilot was a test of the use of an energy efficiency loan program as a consumer benefit as well as an investment in demand side management for the utility. The co-ops utilized on-bill financing to enable the pilot participants to finance energy efficiency measures – including duct sealing, attic insulation and appliance upgrades – utilizing low-interest loans that are repaid on the homeowner’s monthly electric bill. The results of the program revealed that the average home reduced energy use by 34 percent or 11,000 kWh per year, with an average annual savings of over $1,100 per year, more than enough to cover the annual payments required for the 10-year loan.

While the South Carolina program was funded in large part by a grant from the U.S. Department of Agriculture’s Rural Economic Development Loan and Grant Program, other co-ops and local government municipal utilities are developing on-bill financing options using internal funds or partnering with third parties like local credit unions and community development financial institutions (CDFIs). These programs range from water heat replacement programs or basic weatherization upgrades to full energy efficiency retrofit programs, but they all have one thing in common. They are all sponsored by the utility itself and they all offer repayment of the cost of the improvements through the utility bill. On this new “utility” bill, a homeowner can see the effects of their improvements – not only in reduced energy usage, but also how their reduced energy costs help to pay off their loan.

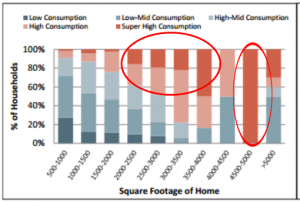

The Environmental Finance Center has been working with utilities to analyze residential customer usage and can assist local government and rural cooperatives collect and analyze customer electricity rates, usage, and expenditure data in order to expand the understanding of residential electricity customer profiles and usage, particularly among economically vulnerable populations that may need assistance with their monthly bills. We can help to evaluate the customer level impact of energy efficiency initiatives and determine which customer groups have the most room for efficiency gains. In some cases the target customer, like the Smith family, may seem obvious. In other cases, the data reveals a segment of utility customers that had previously been overlooked – like the ‘Super High Consumption’ segment of customers shown below:

As homeowners increasingly find themselves looking at growing energy bills and utilities strive to provide safe, reliable and affordable energy to all their customers, on-bill financing and a targeted approach to encouraging energy efficiency projects could provide a win-win for the entire community.

Does your utility offer on-bill financing? Share your story below!

Very helpful analysis and visualization of % of households in the different categories. While there seem to be many anecdotal examples of the smaller older homes, specifically ones with low- to moderate-income inhabitants, having higher energy bills, it would also be interesting to see stratification by income and % of total housing units at each square footage category to really get a feel for the best segment to target.