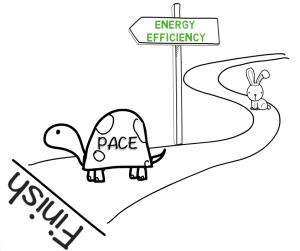

In case you haven’t heard, Property Assessed Clean Energy programs have picked up the …. well, they’ve picked up the PACE. And just in the nick of time, as many federally-funded clean energy programs are running out of steam. Thirty states, including six in the Southeast, have enacted PACE-enabling legislation that gives local and state governments the authority to fund a property owner’s upfront costs for renewable energy system installations and energy efficiency improvements, enabling repayment through property assessments. These assessments are secured by the property itself and are paid as an addition to the owners’ property tax bills. Although residential PACE programs were initially off to a slow start, recently launched programs in California, Missouri, New York and Texas reveal that residential PACE, like its commercial PACE counterpart, might just take us across the clean energy finish line.

In case you haven’t heard, Property Assessed Clean Energy programs have picked up the …. well, they’ve picked up the PACE. And just in the nick of time, as many federally-funded clean energy programs are running out of steam. Thirty states, including six in the Southeast, have enacted PACE-enabling legislation that gives local and state governments the authority to fund a property owner’s upfront costs for renewable energy system installations and energy efficiency improvements, enabling repayment through property assessments. These assessments are secured by the property itself and are paid as an addition to the owners’ property tax bills. Although residential PACE programs were initially off to a slow start, recently launched programs in California, Missouri, New York and Texas reveal that residential PACE, like its commercial PACE counterpart, might just take us across the clean energy finish line.

Keeping PACE with Residential Clean Energy Programs

PACE is a relatively new way to encourage investment in clean energy projects. When authorized by state law, PACE programs allow local governments, state governments, or other inter-jurisdictional authorities to fund 100 percent of the upfront costs for clean energy projects. Property owners voluntarily choose to participate in a PACE program and repay the assessment annually on their property tax bill. In addition to reducing the property owners’ upfront costs, PACE financing ties the cost of building improvements to the property itself. If a property owner participating in a PACE program sells the property, then the repayment obligation legally transfers with the property.

In most states, the state legislature must authorize cities or counties to establish PACE financing programs. Only property owners within a local jurisdiction that opt in to a PACE program may receive financing and are subject to the special assessment. Cities or counties may use their bonding authority to finance programs or partner with third party private investors. In addition, some local governments with reserves or investment portfolios may choose to use them as a source of capital for the PACE program.

But while many states have authorized local governments to create PACE financing programs, few states have enacted a residential PACE program, primarily due to concerns expressed by the Federal Housing Finance Agency (FHFA) regarding the first lien priority position of PACE assessments. Until now. Recent programs established in California, Florida, Missouri, and Texas reveal that with the right underlying financing structure, residential PACE programs can, and are, moving clean energy investment forward.

The Slower Southeast PACE

Although few residential PACE programs have been developed in the Southeast, six southeastern states have moved forward with PACE-enabling legislation and four states (Florida, Georgia, Louisiana and Virginia) have launched, or are in the process of developing, a commercial PACE program:

| Alabama | No PACE enabling legislation. |

| Arkansas | Arkansas has enacted PACE enabling legislation. |

| Florida | Florida has enacted PACE enabling legislation and at least one commercial program has launched, with others near launch or in development. |

| Georgia | Georgia has enacted PACE enabling legislation and there is a commercial PACE program in development. |

| Kentucky | No PACE enabling legislation. |

| Louisiana | Louisiana has enacted PACE enabling legislation and there is a commercial PACE program in development. |

| Mississippi | No PACE enabling legislation. |

| North Carolina | North Carolina has enacted PACE enabling legislation. |

| South Carolina | No PACE enabling legislation. |

| Tennessee | No PACE enabling legislation. |

| Virginia | Virginia has enacted PACE enabling legislation and there is a commercial PACE program in development. |

Source: PACENow, http://pacenow.org/resources/all-programs/

In the southeast, there is tremendous opportunity for low-cost, easy to implement energy efficiency finance programs and a successful PACE program can help to answer the “how do I pay for it?” question that is on the lips of many homeowners.

Residential PACE Programs to Watch

- California recently launched the CaliforniaFIRST program, a public-private partnership between the California Statewide Communities Development Authority and Renewable Funding, a private investor. The program was launched in 17 California counties and 167 cities. Key to this program’s success is a state-directed loan loss reserve fund that can be used to mitigate the potential risk to mortgage lenders associated with residential PACE. https://californiafirst.org/

- In south Florida, a Clean Energy Green Corridor has been established for single family homes. Ygrene Energy Fund has established a PACE program to help homeowners in the Green Corridor pay for home energy improvements. https://ygrene.us/fl/green_corridor/residential

- Set the Pace St. Louis is a residential and commercial PACE program developed to promote energy efficiency, reduce the city’s carbon emissions and increase jobs. http://www.setthepacestlouis.com/

- Texas has developed its own “Pace in a Box” toolkit to promote a consistent, state-wide approach to PACE design and implementation for residential, commercial and industrial properties. The toolkit standardizes the design of PACE programs in Texas and contains all of the documents and implementation steps necessary for a local government to establish an effective PACE program quickly and economically. http://www.keepingpaceintexas.org/

Residential PACE may have gotten off to a slow start, but it is growing in momentum. And like the tortoise, sometimes slow and steady might actually win the race.

Jen Weiss is a Senior Finance Analyst at the Environmental Finance Center at UNC Chapel Hill.

Leave a Reply