It’s a scene played out across the country: a rural electricity service area where many residents are low-income, homes are far apart, a number of customers rent, and many live in homes over 40 years old.

Ouachita Electric Cooperative’s members, in an area with a median household income of $25,256, are exactly those who could benefit from the lower electricity bills that come with reduced usage. But its member-customers are often not in a financial position to invest in energy efficiency. The cooperative, located in southwest Arkansas, has found a way beyond these barriers and has embraced an energy efficiency financing technique in their innovative HELP PAYS program (Home Energy Loan Program – Pay As You Save), which uses on-bill financing to fund retrofits.

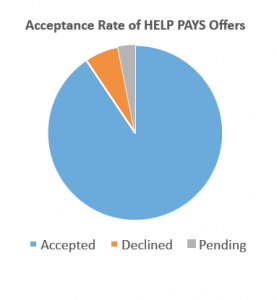

According to a report the cooperative published in July 2017, comparing HELP PAYS to an earlier iteration of the program, the first year of HELP PAYS resulted in participation tripling.

From April 1, 2015 to December 31, 2015, the older efficiency loan program, simply known as HELP, served 70 members—all owners of single family homes. But over the same period during 2016, HELP PAYS investment offers were sought and accepted by 118 single family homes, 82 units of multifamily housing, and two commercial customers. Approximately one third of those accepted offers were conditional on a co-payment.

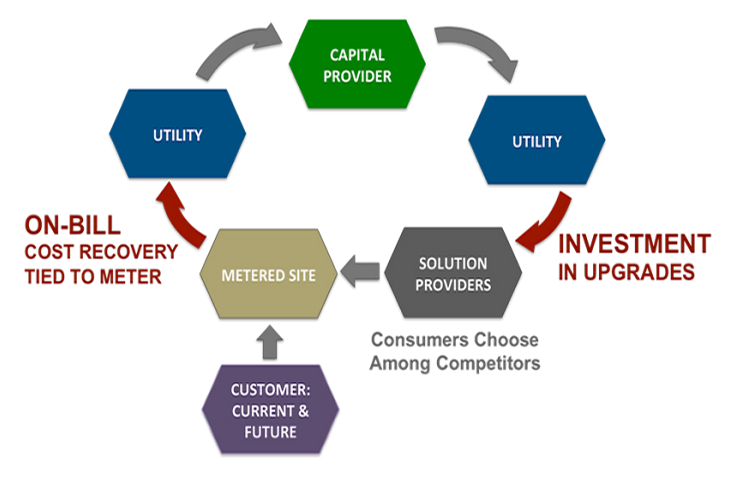

The HELP PAYS program is a tariffed on-bill finance program, where efficiency upgrades are financed not through a loan, as with the previous HELP program, but rather through a utility offer that pays for upgrades under the terms of a new, additional tariff on the customer’s monthly bill. This tariff includes a cost recovery charge on the bill that is less than the estimated savings. This tariffed on-bill program offers a number of advantages to participants over the earlier loan program.

Alternative Underwriting

One hallmark of a tariffed on-bill finance program is that it enables customers to qualify for the program outside of traditional underwriting standards. This means that HELP PAYS is available to a more diverse audience.

Reaching customers who may not otherwise have had access to conventional financing, Ouachita assures cost recovery for the utility through a fixed charge on a participant’s bill called a Program Service Charge. This charge is capped at 80 percent of the estimated savings within 80 percent of the useful life of the upgrades, assuming no escalation in rates. As a result, the portion of the estimated monthly net savings that a participant keeps as immediate net savings is 20 percent or higher—compared to an average of zero immediate net savings in HELP or other traditional, bill neutral loan programs. Among residential participants, the average estimated net savings were greater than $100 per year.

HELP PAYS Program Investment and Cost Recovery Model

Dodging Debt

These savings come with no new debt obligation for the member-customers and assure the utility a low risk path to cost recovery through a charge on the bill that is less than the estimated savings from the upgrades. Since the customer’s new bill is lower no matter what, the likelihood of the customer paying in full is presumably increased. Ouachita assures the upgrades continue to function throughout the period of cost recovery and, once cost recovery is complete, all upgrades (and subsequent savings) belong to the owner of the home.

Instead of providing a loan to pay for an improvement that burdens a customer with debt—as Ouachita’s previous program did— the HELP PAYS method is tied to the home’s meter. Regardless of specific metrics that must be present, like payoff length and if a co-pay is needed, the HELP PAYS program results in instant on-bill savings for the customer.

Appeal to Renters

More than one third of HELP PAYS participants in the examined period were renters, a group who had been ineligible to participate in the HELP loan program. The renters’ landlords readily supported the program, agreeing to pay co-payments, if needed, in order to qualify upgrades to meet the program’s threshold for cost effectiveness.

Among the renters in multi-family housing, 100 percent of those receiving HELP PAYS offers accepted the terms of the opt-in charge, and—where co-pays were required—the landlords agreed to pay for 100 percent of the co-payments associated with those units. In this situation, the landlord is getting an energy efficiency improvement to their property at a discount; only costing them the co-pay, while the renter is covering the remainder of the cost, whose monthly bills are now lower than before.

The HELP PAYS program ties the improvements to the home, freeing renters from taking on debt for energy efficiency improvements on a home they do not own. By tying the efficiency upgrade to the meter, not the customer, if the property sells or is foreclosed on, cost recovery continues with the new property owner.

The homes Ouachita upgraded last year were, on average, 40 years old. There are a lot of inefficient homes and apartments in its service territory, meaning large savings opportunities. Upgrades for single-family homes returned annual energy savings of 30 percent, while apartment dwellers, a difficult-to-engage segment, saw energy savings climb even higher to 35 percent. While the nation’s grid infrastructure continues to age and electricity efficiency becomes more of an issue than ever before, Ouachita’s HELP PAYS program could serve as a model tackling these issues in communities across the country.

Liz Harvell is the Outreach Coordinator at the Environmental Finance Center. She graduated from UNC-Chapel Hill in May 2017 and majored in Business Journalism with a minor in Environmental Science and Studies.

Leave a Reply