Caroline Simpson is a graduate student with the UNC School of Information and Library Science and works as a Research Assistant with the Environmental Finance Center.

The 2012 election results are in! Last week, eleven out of eleven conservation finance measures passed (many with strong margins) across the country; voters supported watershed protection by approving local government bonds and special taxes.

The following special taxes and bonds will go toward the protection of open spaces and specifically mention watershed or water quality protection:

|

Location |

Measure |

Approved Funds |

Approved Conservation Funds |

|

| Gunnison County, Colorado | 20-year, 1% Sales Tax Extension | $4,600,000 | $4,600,000 | 80% to 20% |

| Scio Township in Washtenaw County, Michigan | 10-year, .4942 mill property tax extension | $6,310,000 | $6,310,000 | 68% to 32% |

| Stark County Park District | 8-year, 1 mill replacement and increase levy property tax | $54,400,000 | $19,712,000 | 51% to 49% |

| Kirkland, Washington, Ohio | .16 per $1000 of assessed value property tax | $46,900,000 | $7,691,600 | 57% to 43% |

| Mountains Recreation & Conservation Authority (Special District), California | 10-year, $24 parcel tax, land East of Santa Monica Mountains | $6,810,000 | $1,702,500 | 76% to 24% (2/3 required) |

| Mountains Recreation & Conservation Authority (Special District), California | 10-year, $19 parcel tax, land West of Santa Monica Mountains | $3,050,000 | $762,500 | 68% to 32% (2/3 required) |

Polk County in Iowa, Beaufort County in South Carolina, two districts in Oregon and the city of Austin, Texas also successfully passed bonds marked for watershed protection . These measures do not exclusively fund watershed protection; they can be used to protect and acquire other areas like rangelands, wildlife habitats, and open space in general. However, they are great case studies for whether or not these mechanisms could fund water quality activities and the conservation of wetlands in other locations.

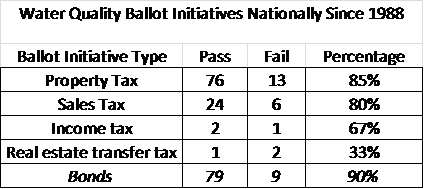

To put this year’s election numbers in perspective, here is a look at how local water quality ballot initiatives have faired since 1988:

In particular, local governments from Colorado, New Jersey, Ohio, and Michigan have implemented a notable amount of property tax and sales tax initiatives for water quality throughout the years while income tax and real estate transfer taxes make up a very small percentage of these initiatives. It’s also important to note that states have different rules for referendums and some of these taxes may be in place around the country without a ballot initiative process. Regardless, it makes sense to explore the public’s opinion of environmental finance measures when the information is available, and this year communities with the option to vote for local government taxes and bonds for water quality issues said yes.

Approved Local Government Ballot Initiatives for Water Quality (excluding bonds) since 2000

To see full map of local government ballot initiatives since 2000, click here http://bit.ly/PGpZcI.

All of this information was provided by the LandVote Database by The Trust for Public Land, a free online database that keeps comprehensive records from 1988 to present of conservation ballot measures: https://www.quickbase.com/db/bbqna2qct?a=dbpage&pageID=10

0 Comments

1 Pingback