Sarah Royster is a graduate student with the UNC School of Public Health pursuing a Master’s Degree in Environmental Engineering. She works as a Research Assistant with the Environmental Finance Center.

Restrictions on reserve funds vary greatly from utility to utility. Capital-intensive infrastructure projects, customer demand trends, geography, governance and political priorities can affect reserve fund sizes and regulation. The Government Finance Officer’s Association (GFOA) recommends establishing minimum reserve fund levels, and many utilities have specific reserve policies based on expected revenues for the following year. When setting policies for maintaining minimum reserve fund balances, however, several factors should be taken into account, including the volatility of revenues and expenditures, the perceived exposure to financial risk (from natural disasters, customer demand shifts due to weather or drought, unexpected infrastructure repair, etc.), the amount of money and potential drain on other reserve funds, liquidity, and financial commitments to designated reserve funds (GFOA 2009).

A previous blog post describes the different types of reserve funds being used among water and wastewater utilities. Additionally, a reserve fund’s purpose may influence its size. A debt service fund, for example, should be larger for a utility with increased debt obligations than a utility with little or no debt. A hurricane-prone coastal community may have need of a larger contingency fund than a utility without a history of frequent natural disaster, in case it needs to repair extensive damage done to its infrastructure.

It is also important for utilities to plan how resources will be set aside for each unrestricted reserve fund balance, and to put in place mechanisms to protect unrestricted reserves. Politicians, city government leaders, and even savvy citizens may not fully understand the need for adequate reserves and may see it as a utility hoarding funds. Government leaders are often tempted to deplete a utility’s reserve fund to meet other financial needs or meet political goals, as was seen in the City of Park Ridge, IL. In 2010, against the recommendations of utility managers, the city council depleted utility reserve funds to pay for other expenses, noting that the reserve level was excessive (Mann, 2010). This example indicates the importance of setting policies (and ideally seeking board-approval for those policies) for unrestricted fund balances, so that utilities can easily justify reserve levels to local governments.

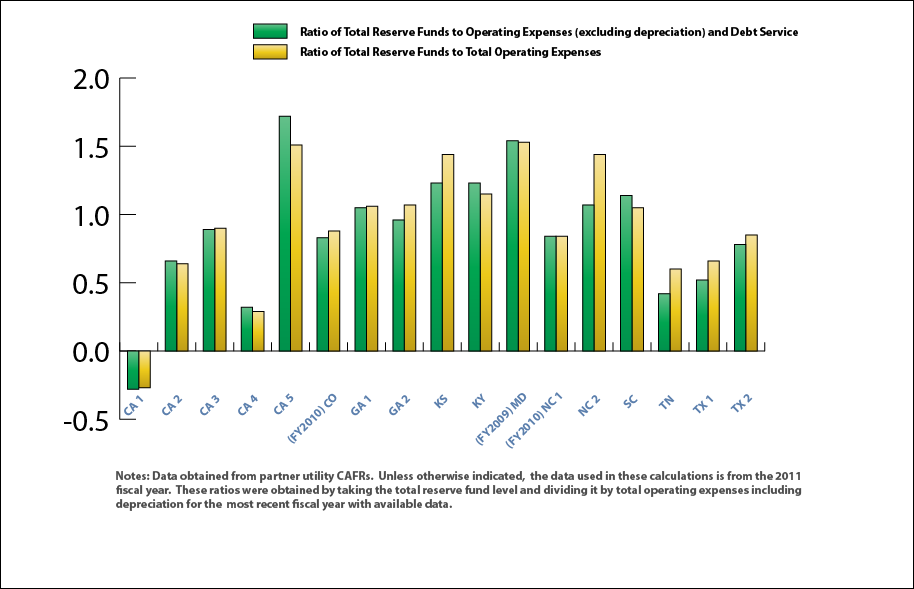

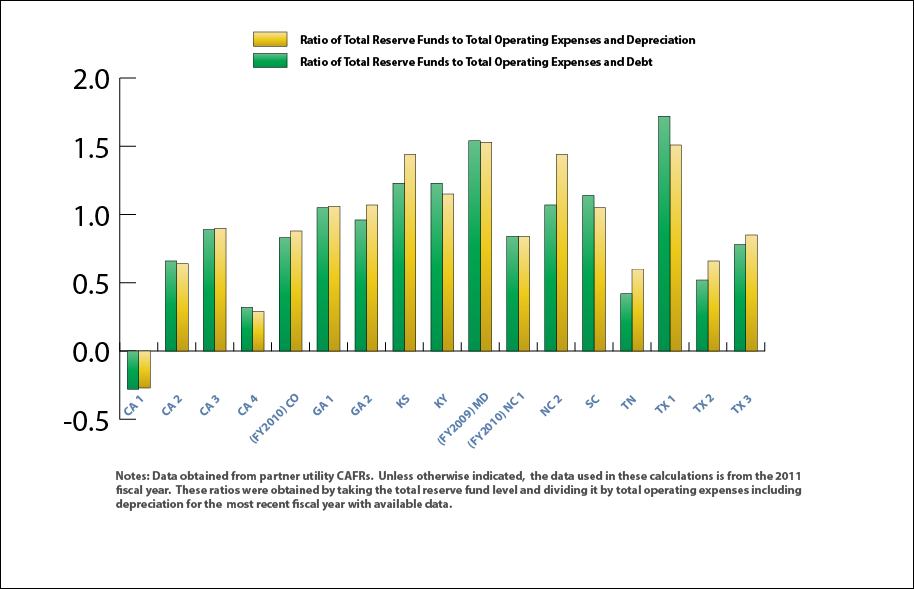

Conversely, some utilities may be keeping too much money in reserve funds, thereby charging customers a higher rate than necessary. It is difficult, however, to determine the right amount that a utility should hold in its reserve funds. Figure A below, depicts reserve fund levels for a few utilities across the country. The green columns show the ratio of total reserve funds (from all types held by the utility) to total operating expenses excluding depreciation, and debt service for each utility for one fiscal year. Similarly, the yellow columns show a ratio of total reserve funds to total operating expenses.

Figure A. Ratio of total reserve funds to the total operating expenses (excluding depreciation) and debt service alongside ratio of total reserve funds to total operating expenses

These ratios can act as an indicator of reserve fund level, and allow for comparison between utilities. Values over 1.0 indicate that a utility has enough in its reserve funds to pay for a year’s worth of O&M expenses and at least some capital costs. Utility CA 5 has a very high ratio in both figures (1.72 and 1.51 respectively), meaning that their reserve funds alone can cover costs for a year and a half. While this ratio is higher compared to the other utilities, CA 5 has a “pay as you go” policy, allowing them to accumulate money in reserve funds for use on capital improvement projects and for long-term planning, rather than relying on debt to pay for capital projects. Utility NC 2 also has a ratio greater than 1, which is reflected in their financial goal to achieve a 40% to 60% mixture of “pay as you go” financing. The average of the ratios across the 17 utilities is roughly 0.9, although it varies widely from utility to utility. The ratio of reserve funds to total operating expenses, however, tends to be slightly higher than the ratio of reserve funds to operating expenses (excluding depreciation) and debt, indicating that debt service payments are slightly higher than depreciation expenses for many of these utilities.

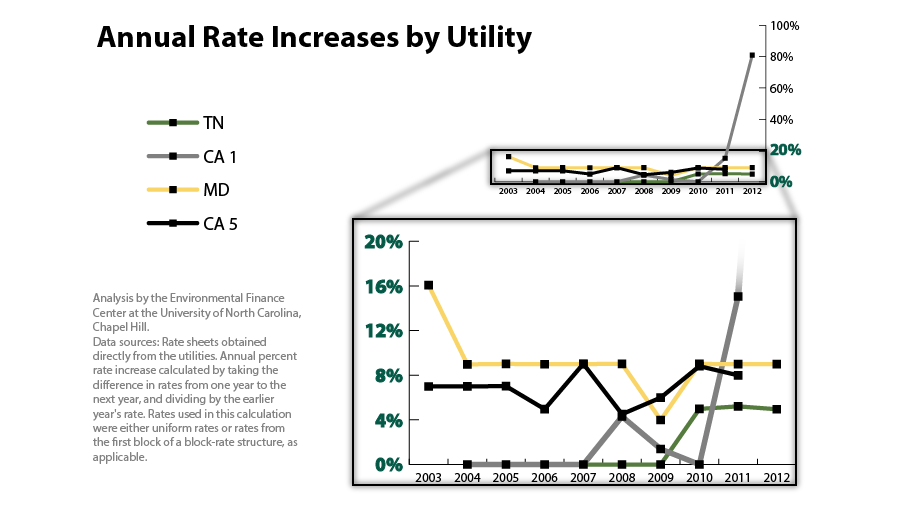

Figure B. Annual percent rate increases for utilities with high reserve funds to total operating expenses ratios

Figure B shows the annual percent rate increase for the two utilities with the highest ratios from Figure A, and the two utilities with the lowest ratios. Note that a value of zero indicates no rate increase from the previous year. Utilities CA 5 and MD (with the highest ratios) had consistently higher rate increases than those utilities with lower ratios. Utility MD had the highest ratio of total reserve funds to total operating expenses. Their rate increases seemingly reflected this trend in reserve fund levels, as they consistently had the highest rate increases of these four utilities (although the rate increases remained very consistent for a number of years, and are generally in line with rate increases observed in North America). Utility CA 5, however, had a similarly high ratio, yet their rate increases tended to be lower.

The two utilities with the lowest ratio of reserve funds to operating expenses, had drastically different trends in rate increases. Utility TN had no rate increases for years, before raising rates slightly in 2010, 2011, and 2012. Similarly, Utility CA 1 (the only utility with negative ratios), did not increase rates for a number of years. In 2011 and 2012, however, this utility had drastic rate increases, reaching an increase of 81% from 2011 to 2012. This is indicative of a trend among utilities with lower ratios; while rate increases are not generally higher or lower for utilities with low ratios, they are more volatile. The standard deviation of rate increases for a number of utilities was calculated. The volatility of rate increases (measured as standard deviation) tended to be inversely proportional to the ratio of total reserve funds to total operating expenses (excluding depreciation) and debt service costs. For example, utility CA 5 had the highest ratio (meaning they had high levels of reserve funds), but had the lowest volatility of rate increases. Utility CA 1 had the lowest ratio and the highest volatility of rate increases. These results may point to utilities using high reserve fund levels as a buffer to normalize rate increases to a steady annual rate. Whether aiming for high reserve fund levels led to rate increases or if the rate increases led to high reserve funds is less clear, and perhaps both happen concurrently.

The variability in reserve fund levels compared to operating expenses indicates that they are highly dependent on a utility’s reserve fund policies, and ultimately how risk-averse a utility is. It is therefore very difficult to use financial metrics to determine whether a utility has too much saved in its reserve funds, at least without comparing to the Capital Improvement Plan projections of capital costs into the future.

CORRECTION: February 27, 2013

Due to an editing error, the utility marked CA 5 (California #5) was previously marked as a Texas based utility.

References

GFOA (Government Finance Officers Association). 2009 Appropriate Level of Unrestricted Fund Balance in the General Fund. Government Finance Officers Association Best Practice. October 2009. Accessed online at: <http://www.gfoa.org/index.php?option=com_content&task=view&id=1450>.

Mann, Jason. “How Much Is Enough Utility Fund Reserve?” Weblog post. StepWise Utility Advisors, 28 Jan. 2010. Web. 1 Feb. 2013. http://www.stepwiseadvisors.com/how-much-is-enough-for-utility-fund-reserve.

Utlimately, reserves (except those required by law or covenant) should serve the purposes of operational and financial stability. They should be based on risk and consequences. Having a consultant review reserve levels and polices help provide public acceptance. It could be done in conjuction with a periodic cost of service study. Having to high of reserves is confiscation of public funds and should be avoided. However, figuring out what is too high can be difficult.