Sarah Royster is a graduate student with the UNC School of Public Health pursuing a Master’s Degree in Environmental Engineering. She works as a Research Assistant with the Environmental Finance Center.

Economic decline in the past decade has created financial hardships not only for individuals and businesses, but also for water utilities. Utilities can be impacted by economic conditions in a variety of ways. Many utilities, for example, decided to take advantage of low interest rates in 2012 according to a special report by Standard & Poor’s, contributing to a 40% increase in bond issuance from the previous year. Utilities, however, are also experiencing revenue shortfalls due to increasing costs and infrastructure needs, and declining revenues. This financial hardship for utilities results in the need for rate increases. Water utility rates have increased far faster than projections of changes to disposable income, and water and sewer bills have been increasing faster than inflation since 2000 (Chapman, Breeding, & Buswick, 2013). These economic conditions also negatively impact utility customers, and create a “downward spiraling” trend in utility revenue and customer affordability (read more about customer affordability indicators here). Local income levels have fallen with the economy as poverty and unemployment rates have increased, and customers have become increasingly cost-conscious. This often leads customers to reduce their water bills by decreasing consumption, subsequently reducing utility revenues. Utilities must then consider rate increases to help mitigate these revenue losses. This cycle can prove detrimental to utility financial health.

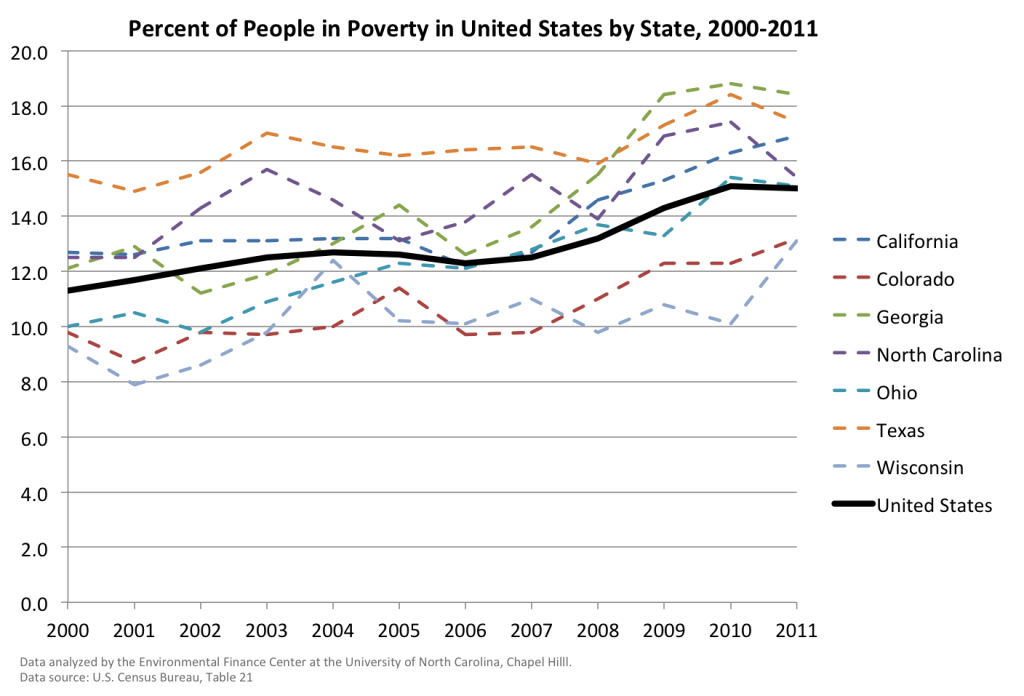

The figure below shows gradual increases in the percent of people living in poverty nationally, and by state. It is clear that the percentage of people living in poverty has steadily increased in all seven states shown, and nationally, since 2000. While Texas had a consistently higher percentage over this period, Georgia saw a significant increase in poverty between 2006 and 2009.

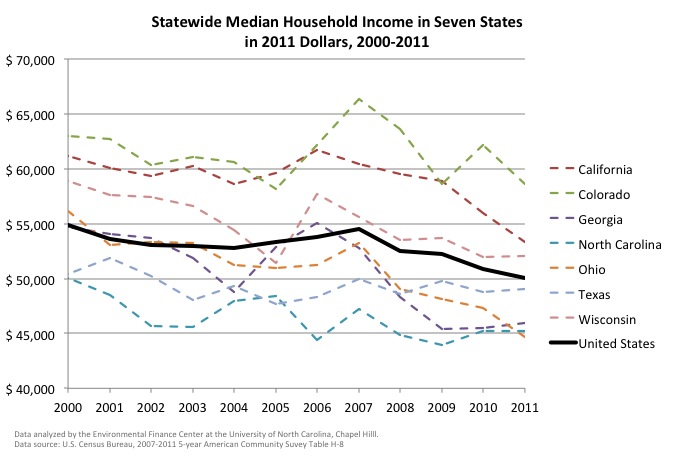

The second figure shows the statewide median household income in 2011 dollars, for seven states from 2000 to 2011. Corresponding to the increases in poverty seen in the previous figure, this shows a declining trend in median household income. The nationwide income decreased by about $5,000 over the 11 year period with some states seeing a decrease of almost $10,000. While economic conditions can put strain on utility finances, they also impact household income and poverty levels, making it even more difficult for utilities to mitigate revenue losses.

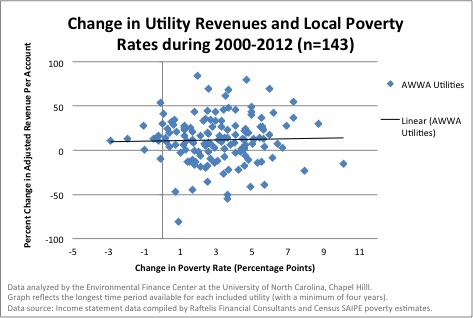

This poses a challenge for utility governing boards, which must set water rates that are affordable to their customer base, while also keeping rates high enough to cover operation and maintenance expenses as well as to meet debt obligations and other financial targets. To make matters worse, Standard & Poor’s projects that, while the economy will recover, it will be a slow and arduous process (Chapman, Breeding, & Buswick, 2013). Additionally, unemployment rates have grown in the past decade, but the revenue gain per account has decreased for many utilities (shown in the final figure).

This could be due in part to a national decrease in the average number of people per household; however, water conservation programs and efforts to save money at a household level are also to blame for the decrease in revenue per account. How will utilities weather this financial drought? While rate increases or restructuring can provide some relief, these efforts may be hindered by utility governing boards. There is no obvious solution to this problem, but it is apparent that a utility’s financial health is largely tied to the country’s economic conditions.

References

Chapman, Theodore. James Breeding & Geoffrey Buswick. 2013. U.S. Municipal Water and Sewer Utilities Face Continued Rate and Drought Pressure in 2013. Standard & Poor’s Rating Services Rating Direct Report. January 29, 2013.

0 Comments

1 Pingback