The 1997 EPA Financial Capability Assessment (FCA) consisted of a two-part assessment to determine a municipality’s financial capability to implement projects to comply with Clean Water Act (CWA) requirements. The EPA has used the 1997 FCA to negotiate implementation schedules for both combined sewer overflow and sanitary sewer overflow controls. The first part of this assessment is the Residential Indicator (RI), which is the cost per household of CWA compliance divided by the median household income. The second part is the Financial Capability Indicator, which evaluates the municipality’s fiscal health and its demographics relative to national norms.

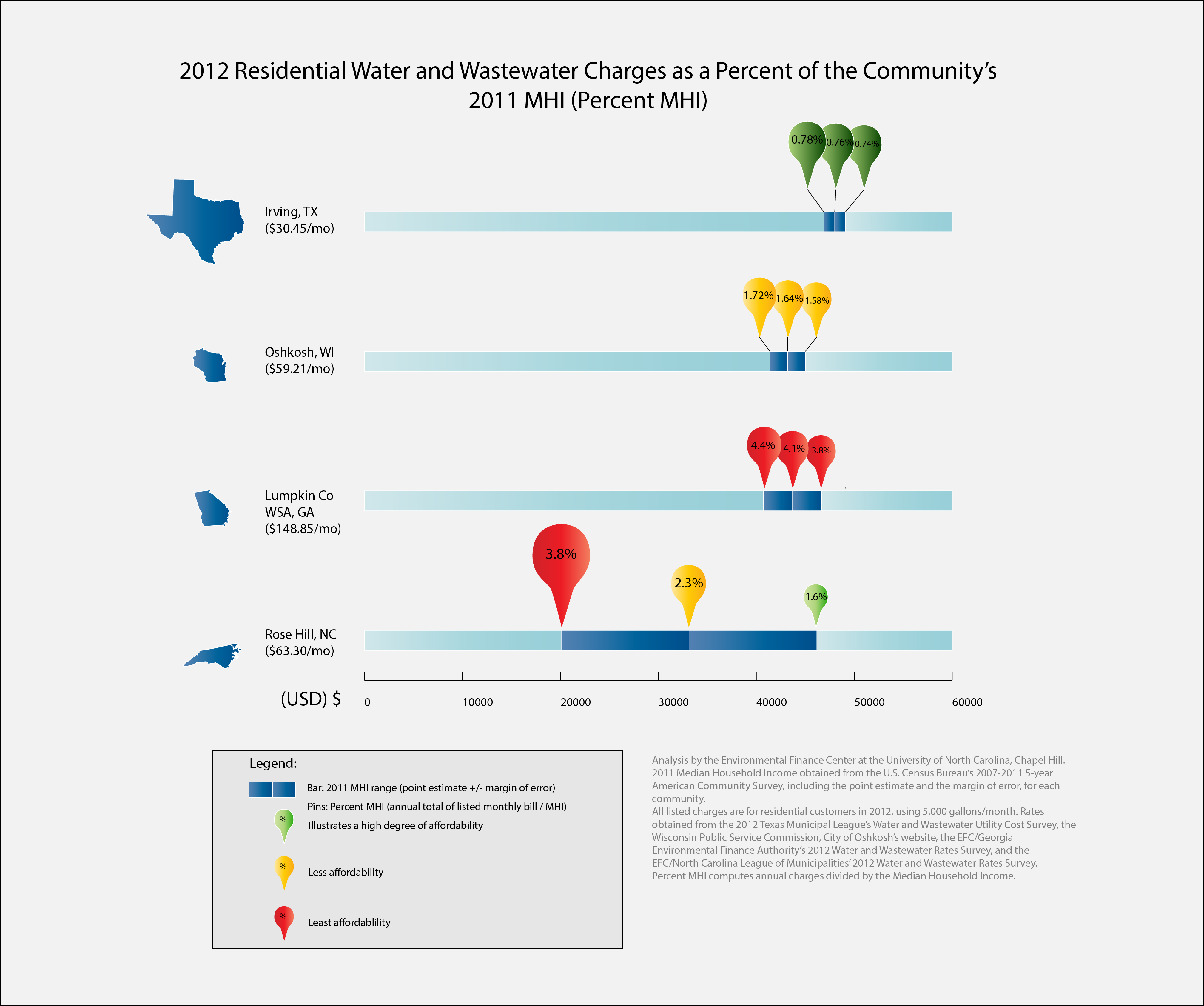

In part due to the simplicity of the Residential Indicator, the water and wastewater community has used a similar metric known as median affordability or % median household income (MHI) to assess affordability at the local level. Median affordability is the annual water and wastewater bill at a set consumption volume divided by the MHI of the service area. State revolving funds also have used median affordability to determine which municipalities are eligible for principal forgiveness on loans. The difference between the RI and median affordability is that median affordability uses the current cost to the customer and the RI uses the total cost to implement CSO or SSO controls to comply with Clean Water Act requirements. Because both the RI and the median affordability rely on MHI to determine affordability, they have both received criticism over the years, including from the EFC (here, here, here).