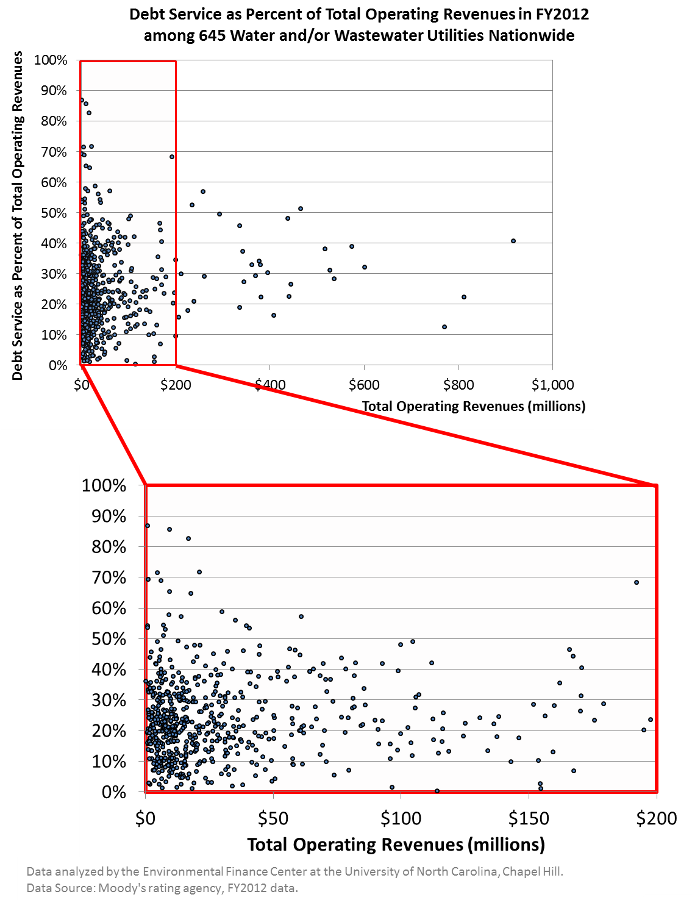

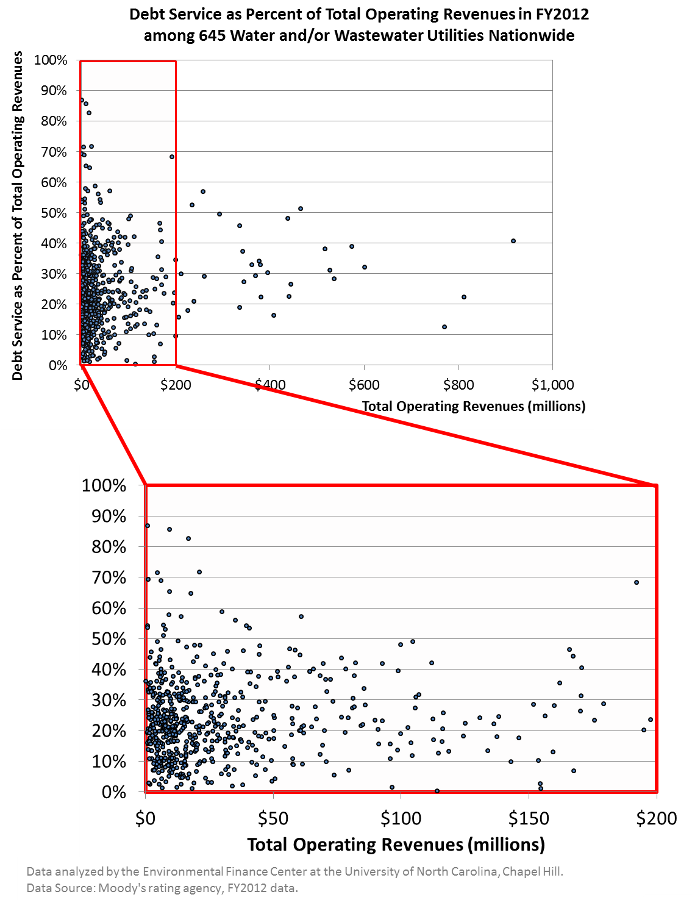

Last Thursday, while we were presenting one of two Water Research Foundation webinars (view recordings of the webcasts for free) on the financial strategies that water utilities have or can employ to improve revenue resiliency against changing financial trends, a participant on the webinar asked if we have any benchmarks on debt service as a percent of operating revenues. The graph above shows how debt service in FY2012 compared to the total operating revenues of 645 debt-paying water/wastewater utilities across the U.S. from Moody’s rating agency. 58% of the debt-paying utilities spent between 10% and 30% of their total operating revenues on debt service in FY2012. Only 11% of the utilities spent more than 40% of their revenues on debt service in that year. There does not seem to be a major distinction between small and large utilities in terms of the proportion of revenue spent on debt service. In our recently published WRF report, Defining A Resilient Business Model for Water Utilities, we showed that this proportion of debt service to operating revenues remained relatively steady between FY2003 and FY2012, despite declining water use. Spending a quarter of annual operating revenues on debt service requires careful financial planning on behalf of the utility since debt service is a fixed cost that must be paid regardless of fluctuating water sales and revenues. These findings are part of the research for Water Research Foundation project #4366.

A $napshot is a graphic revealing an interesting environmental finance finding accompanied by a short post. This $napshot was created by Shadi Eskaf.