Michael Chasnow is a Finance Analyst with the Environmental Finance Center.

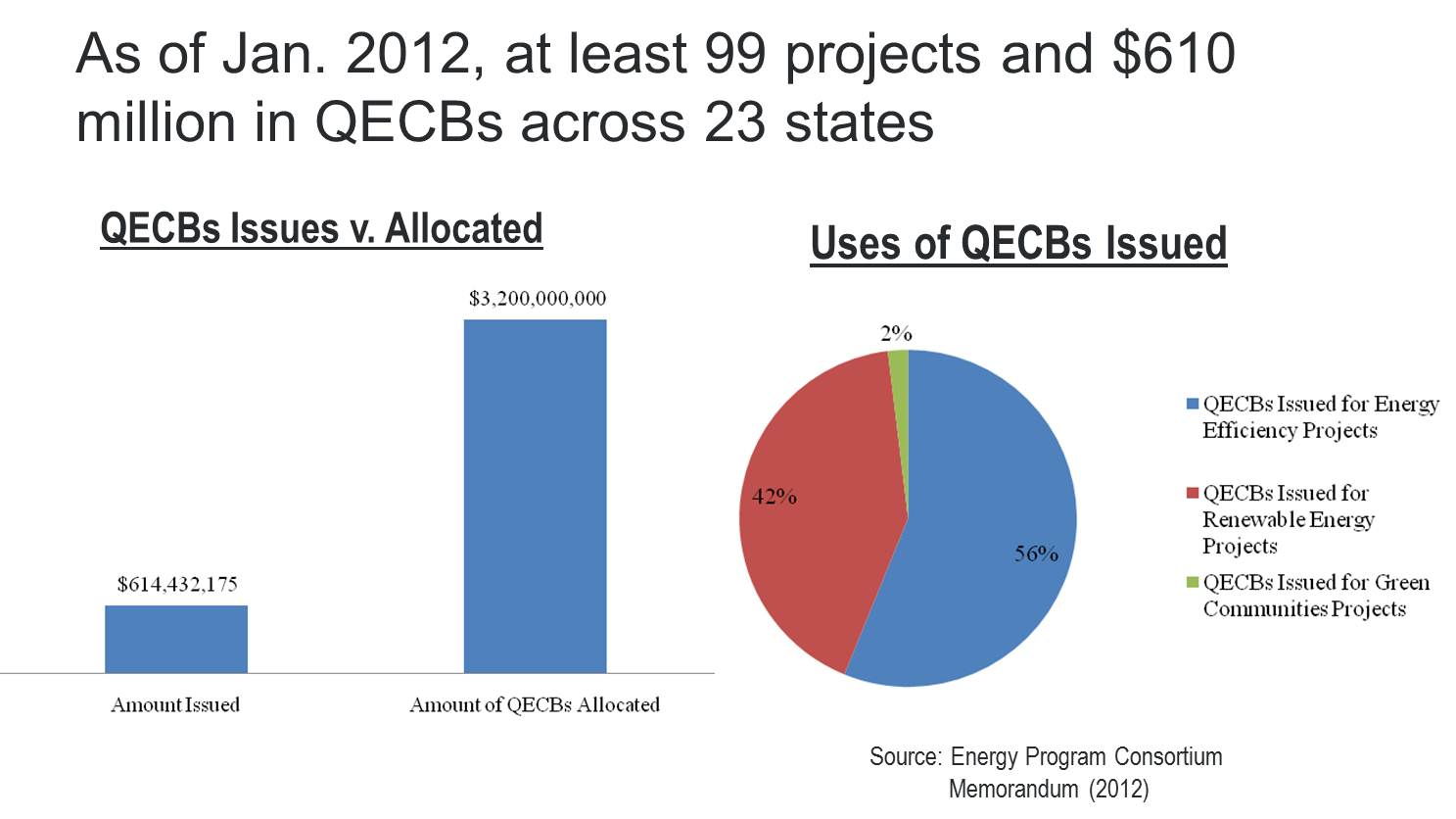

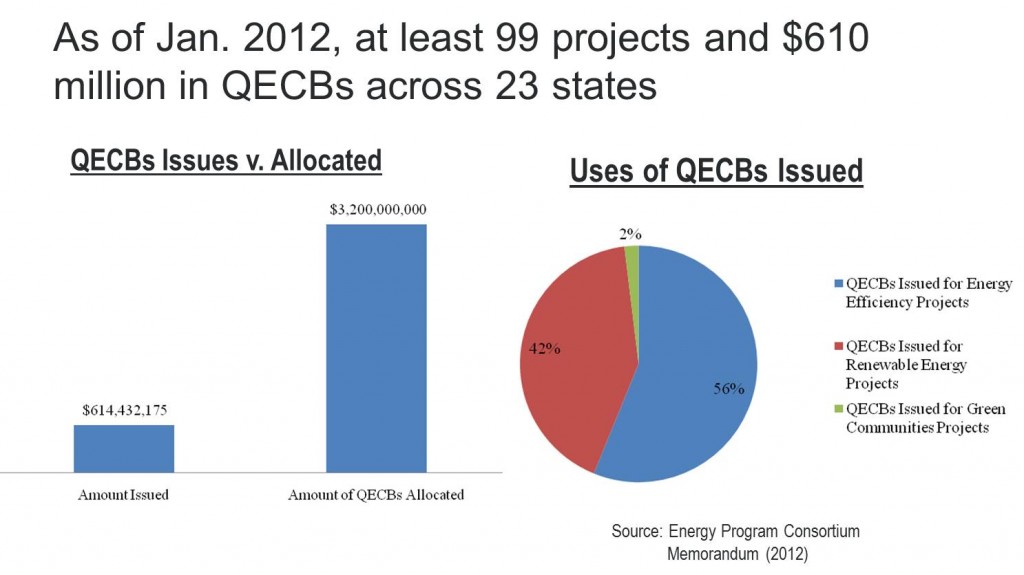

Qualified energy conservation bonds (QECBs) are an exciting tool that states, counties and cities can use to cheaply finance energy efficiency and renewable energy projects within their jurisdictions. QECBs are similar to Build America Bonds (“BABs”) in that the interest on QECBs is taxable but the federal government offers a direct cash subsidy to the bond issuer to subsidize the interest costs. The subsidy on QECBs is twice as large as the BAB subsidy at about 4% (4.29% as of Aug. 21, 2012), making QECBs an extremely low-cost financing option for state and local government issuers. For more on the QECB essentials, check out DSIRE’s detailed description.