If you’ve been on a college campus lately (or received your annual alumni donation request letter), you know that colleges and universities are increasingly focused on “green” initiatives that improve sustainability and reduce campus-wide energy use. While the EPA’s proposed 111(d) standards will make reducing carbon emissions a household phrase, many colleges have been working towards reducing carbon emissions on campus for years.

If you’ve been on a college campus lately (or received your annual alumni donation request letter), you know that colleges and universities are increasingly focused on “green” initiatives that improve sustainability and reduce campus-wide energy use. While the EPA’s proposed 111(d) standards will make reducing carbon emissions a household phrase, many colleges have been working towards reducing carbon emissions on campus for years.

More than 675 colleges nationwide have become signatories of the American College & University Presidents Climate Commitment, a network of college and university presidents and chancellors dedicated to promoting sustainability efforts on college campuses. Today, 22 colleges and universities in North Carolina are part of the commitment including UNC-Chapel Hill, Duke University and NC State. Many of these colleges have established a goal of becoming carbon neutral and are taking actions to reduce carbon dioxide emissions in order to achieve a zero carbon footprint. Since no college campus has found a way to reduce the use of fossil fuels on-site by 100 percent, becoming climate neutral on campus must be accomplished through the purchase of carbon offsets – investments in off-campus carbon reduction initiatives.

Leading the Pack

Duke University is leading the pack in the pursuit of carbon neutrality. The University has made a voluntary commitment to be carbon neutral by 2024 and has estimated that it can reduce nearly half of its annual emissions through on campus conservation, energy efficiency and renewable energy projects.

Duke University is leading the pack in the pursuit of carbon neutrality. The University has made a voluntary commitment to be carbon neutral by 2024 and has estimated that it can reduce nearly half of its annual emissions through on campus conservation, energy efficiency and renewable energy projects.

However, even with an aggressive push to reduce on-campus carbon emissions, Duke will need to find ways to offset the remaining campus emissions through the purchase of carbon offsets from off-campus initiatives. To prepare for its fast-approaching carbon neutrality commitment, Duke has invested in carbon offset pilot projects that it considers most promising in terms of volume, cost-effectiveness and benefits to the local, state and regional community. Types of projects have ranged from methane capture projects to carbon sequestration through forestry and land conservation-based projects. Most recently, the University has investigated using investment in community energy efficiency projects – specifically in residential buildings – as a way to invest in locally generated carbon offsets.

Financing Carbon Offsets

Finding (and funding) carbon offsets for a university can be challenging – especially if the offsets are required to be locally-sourced. Although carbon offsets can be purchased for $5 per ton or less on the open market, locally generated offsets – particularly those generated from energy efficiency projects – currently can cost upwards of $100 per ton of carbon offset achieved. That’s a hefty price tag for a university that will need to purchase 183,000 metric tons of carbon offsets annually.

The Environmental Finance Center recently partnered with Duke University to help it identify opportunities and challenges related to particular energy efficiency-related carbon offset projects. Financing Energy Efficiency-Based Carbon Offset Projects at Duke University summarizes and compares seven types of energy efficiency projects that the University could consider, proposes different financing mechanisms to fund each project type, and suggests ways to reduce the costs of each project type, primarily through innovative financing techniques not normally applied. These financing mechanisms include:

- Self-Financing Using Cash and Grants

- Green Revolving Loan Fund

- Credit Enhancements

- Third Party Investment/Tax-Credit Investors

- Crowd-Funded Alumni Investment Program

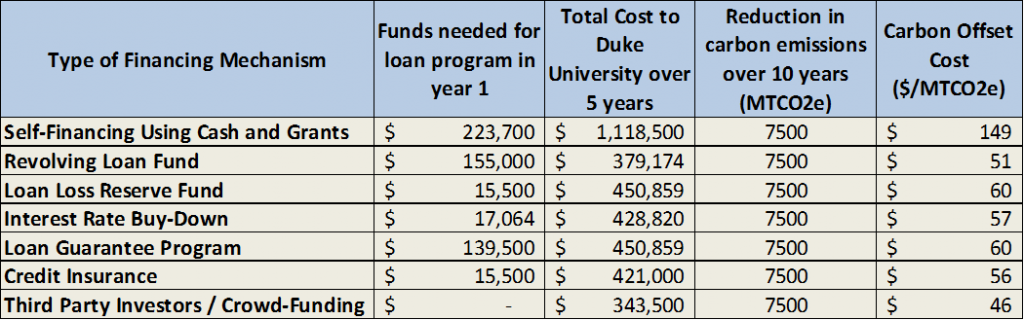

Modeling Financing Mechanisms

To evaluate the relative costs and benefits of each type of financing mechanism, the EFC developed an Excel-based spreadsheet model to compare each of the mechanisms using a sample residential energy efficiency program. For this “apples to apples” analysis, it is assumed that 100 Duke University employees will participate in the program each year for five years, with a total of 500 employees. The cost for each retrofit is assumed to be $2,000, with each homeowner contributing 10% and receiving a utility rebate of $250 for weatherization improvements. It is also assumed that for every participant, Duke University will pay a program cost of $450, which represents $350 for a home energy audit and $100 for a quality assurance check after the retrofit has been completed. A comparison of the start-up costs and cost per carbon offset is summarized in the table below.

Table 1: Cost Per Offset Comparison of Financing Mechanisms

The Path Forward

In this example, the cost of energy efficiency-based carbon offsets range from $46 per offset to almost $150. Based solely on cost per offset, the two less-costly options are a revolving loan fund and third party investors – over $100 cheaper than fully funding the offset purchase. Both of these options, however, will require a considerably longer (e.g., six month to one year) start-up time and higher administrative costs for the university. The mechanisms that appear to be the best fit with the university’s objectives in the short term are the interest rate buy-down and loan loss reserve fund options. Both of these programs can be established relatively quickly with a partnering financial institution, require a minimal amount of funds from the university to start the program, and require minimal university administrative costs. In addition, by partnering with a financial institution to perform the underwriting for the loans, the university reduces the internal risk of borrower default and keeps the financial transaction at arm’s length.

2024 may be ten years away, but it is fast approaching. As Duke University and other colleges across the country start to switch their focus from internal green initiatives to neutrality commitments, the question of how to fund carbon offsets projects will become more and more consequential. Using a variety of innovative financing mechanisms, the cost per offset can be brought down as each university starts to scale up their investment in carbon neutrality.

Learn More

- Read the entire report, “Financing Energy Efficiency-Based Carbon Offset Projects at Duke University,” here.

- Learn more about the Environmental Finance Center’s work on clean energy for colleges and universities here.

- More on Duke University’s Climate Commitment can be found here.

Jen Weiss is a Senior Financial Analyst at the Environmental Finance Center at UNC Chapel Hill.