There’s no doubt about it. June was HOT. And while extreme temperatures in both summer and winter can make outdoor activities unbearable, they can also send electric utility bills skyrocketing across most of North Carolina and place high demands on the state’s electric utility infrastructure. As heating and cooling equipment are pushed to the max, the demands are made even more significant due to inefficiently insulated and poorly weatherized houses which can cause homes to lose cool air as quickly as it is generated. But the cost to weatherize a home can make energy efficiency improvements unaffordable – particularly for homeowners who are already burdened with basic housing costs that can outweigh their limited income. With the aim of providing these homeowners with a solution that will reduce their energy bills and improve home comfort, a collaborative working group has recently been formed by leading energy advisors in the Southeast. Working with multiple stakeholders across the state, the North Carolina On-Bill Working Group seeks to facilitate the development of programs that educate homeowners about energy efficiency and put financing easily within reach for all income levels.

Author: Jennifer Weiss (Page 1 of 3)

SOG Environmental Finance Ctr

Last month on a sunny day in Raleigh, North Carolina, Governor Pat McCrory extended the state’s 35 percent renewable energy tax credit for one year, pushing the expiration for projects that meet certain criteria to December 31, 2016 instead of the impending December 31, 2015 deadline. As solar installers across the state breathed a small sigh of relief, many potential solar investors were left wondering, “What does this really mean to the cost of solar PV for me?” A few months ago, I was asking myself this very same question. Today, I have a beautiful residential solar PV installation on my roof. Here is my story.

Clearing the Air: Reducing Residential Wood Smoke in Portola, CA

It was a beautiful morning as I made the one hour drive from Reno, Nevada to the small rural mountain valley community of Portola, California. Each turn brought increasingly picturesque views of mountains, forests and lakes. As I started my descent into the city, I noticed a slight haze in the valley. Could it be fog? Was it an oncoming storm? Perhaps a forest fire? At another time of year, it might have been any of these natural causes. But at this time of year – early March, temperatures in the 30’s, no wind – it was none of these. What I was seeing hovering in the valley was a layer of smoke, and I was going to be spending my day discussing the environmental, economic and health benefits of reducing it.

It’s the environmental equivalent of the chicken and egg conundrum. Which comes first? The energy efficiency retrofit (the plump chicken full of opportunity) or the capital (the very large egg) with which to fund it? The answer is “it doesn’t matter.” Because in the world of energy efficiency finance, there is plenty of both – the key is how to integrate them together. Perhaps we have been asking ourselves the wrong question. Perhaps the question should no longer be “which comes first,” but rather “how do we combine the two to build a better chicken coop?”

It’s the environmental equivalent of the chicken and egg conundrum. Which comes first? The energy efficiency retrofit (the plump chicken full of opportunity) or the capital (the very large egg) with which to fund it? The answer is “it doesn’t matter.” Because in the world of energy efficiency finance, there is plenty of both – the key is how to integrate them together. Perhaps we have been asking ourselves the wrong question. Perhaps the question should no longer be “which comes first,” but rather “how do we combine the two to build a better chicken coop?”

Last week, a group of over 250 energy efficiency experts gathered in Atlanta, GA for the Southeast Energy Efficiency Alliance’s 2014 “Conference on Innovation.” During the three days of inspiring and thought-provoking sessions, the attendees networked with one another and empathized over common challenges. We laughed, we lamented, and we strategized over how to move energy efficiency forward. In the end, we all walked away with a collaborative feeling of hope and a couple of key themes to take back and build into our energy efficiency programs.

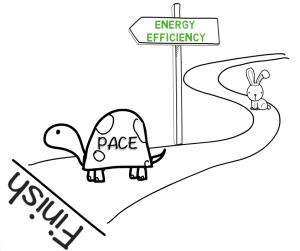

In case you haven’t heard, Property Assessed Clean Energy programs have picked up the …. well, they’ve picked up the PACE. And just in the nick of time, as many federally-funded clean energy programs are running out of steam. Thirty states, including six in the Southeast, have enacted PACE-enabling legislation that gives local and state governments the authority to fund a property owner’s upfront costs for renewable energy system installations and energy efficiency improvements, enabling repayment through property assessments. These assessments are secured by the property itself and are paid as an addition to the owners’ property tax bills. Although residential PACE programs were initially off to a slow start, recently launched programs in California, Missouri, New York and Texas reveal that residential PACE, like its commercial PACE counterpart, might just take us across the clean energy finish line.

In case you haven’t heard, Property Assessed Clean Energy programs have picked up the …. well, they’ve picked up the PACE. And just in the nick of time, as many federally-funded clean energy programs are running out of steam. Thirty states, including six in the Southeast, have enacted PACE-enabling legislation that gives local and state governments the authority to fund a property owner’s upfront costs for renewable energy system installations and energy efficiency improvements, enabling repayment through property assessments. These assessments are secured by the property itself and are paid as an addition to the owners’ property tax bills. Although residential PACE programs were initially off to a slow start, recently launched programs in California, Missouri, New York and Texas reveal that residential PACE, like its commercial PACE counterpart, might just take us across the clean energy finish line.