Guest post by Amanda Sear, Research Assistant, Duke Carbon Offsets Initiative

As the temperature starts rising outside, energy bills can trend skyward as well. In the summer and winter, insufficient insulation and poor weatherization can make houses leak cool and warm air almost as quickly as it is generated. While many people are aware that home energy efficiency improvements can lower utility bills, investments in energy efficiency retrofits are not every homeowner’s priority.

In the interest of encouraging its employees to invest in energy efficiency projects, in 2012, Duke University began a five-year effort to identify the barriers that prevent homeowners from retrofitting their homes and determine the best strategies to overcome them. This culminated in an energy efficiency pilot program aimed to help Duke employees complete energy efficiency home retrofits and track reductions in energy use and carbon emissions. The Environmental Finance Center at UNC provided financial advisory and program management support for this pilot program and collaborated with DCOI on the final evaluation of the program.

The full report, which evaluates the results of Duke’s pilot program and makes recommendations for Duke and other employers implementing employee-based energy efficiency programs, can be found here.

The Barriers to Energy Efficiency

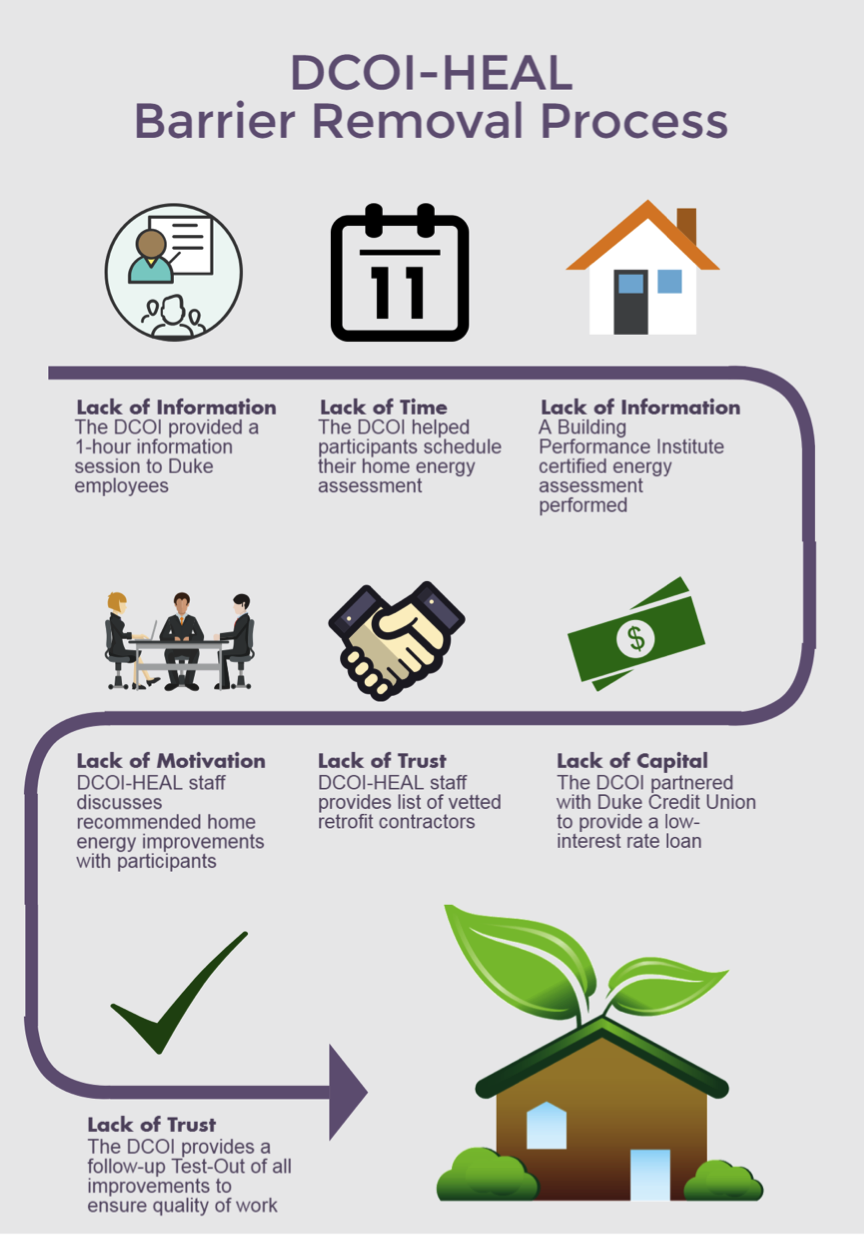

The pilot program revealed that for employee participants, a lack of knowledge about energy efficiency and the upfront cost of improvements are the largest barriers to investing in energy efficiency home retrofits. In addition, research indicated that there are also three secondary barriers: lack of trust in contractors and vendors, lack of time, and lack of motivation to complete the home retrofit process. Taken together, these barriers pose a significant challenge to reducing residential energy use and improving home energy efficiency. A successful energy efficiency program would therefore need to address most, if not all, of these barriers in order to incentivize participants to complete the retrofits.

A Solution: Leveraging the Employer-Employee Relationship to Encourage Retrofits

Fortunately, a well-designed energy efficiency program can successfully overcome all of these barriers and encourage participants to complete retrofits. In 2012, the Duke Carbon Offsets Initiative (DCOI) received funding from The Duke Endowment to design, develop, and implement an employee-based energy efficiency program. DCOI chose to work with employees because as a trusted resource, an employer is often in an ideal position to provide information to an employee on the benefits of energy efficiency improvements. A trusted employer can provide educational resources, time off to have retrofits completed, and even incentives to ease the financial burden.

This chart shows how the program was able to remove the barriers to completing retrofits:

By addressing each barrier, especially by providing a free energy audit, DCOI was able to help over 50% of its 35 program participants complete retrofits. Current data shows that on average, the participants who completed retrofits have saved 14.5% through April 2016 on their energy bills and 11% on their gas bills and 95% of participants were satisfied with the experience.

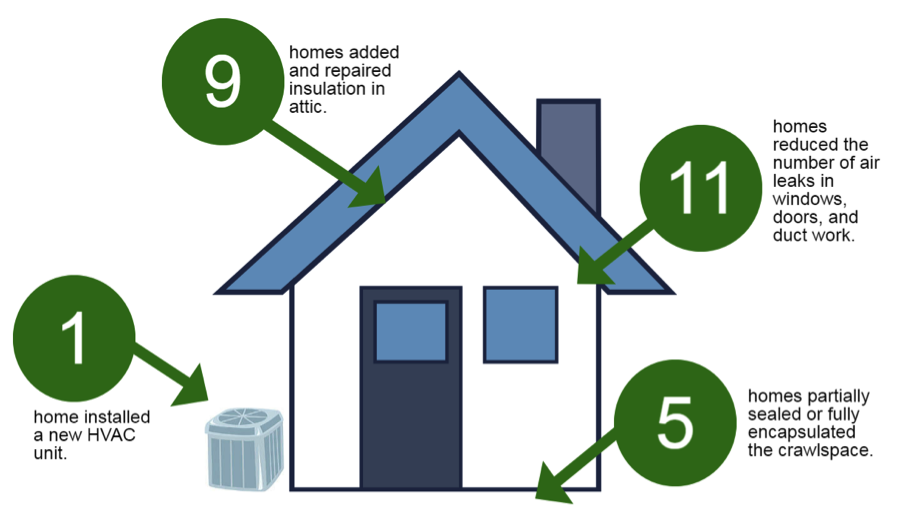

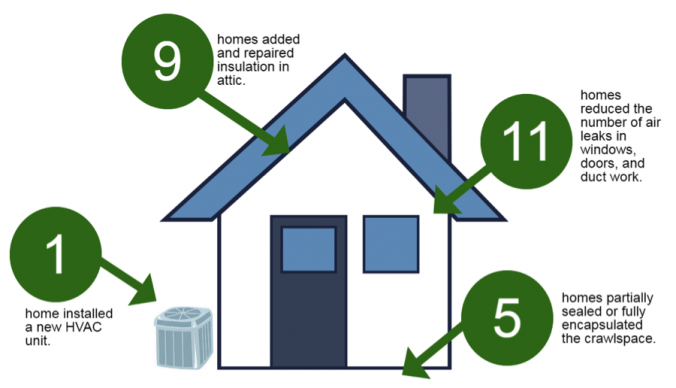

DCOI-HEAL General Retrofits Completed:

Lessons Learned and Next Steps: Promoting Residential Energy Efficiency

Employee-based energy efficiency programs provide an excellent opportunity to overcome some of the traditional barriers to energy efficiency investments that many programs have experienced. By compiling a comprehensive energy efficiency program offering and aligning with key industry partners, an employer can help to improve an employee’s health, comfort, and financial situation while simultaneously generating carbon offsets. As with all benefit programs, the employer must weigh the cost associated with each element and the ultimate benefit to the employee, the community, and the environment. The following are a few of the key lessons learned through the pilot with potential ways to address them in the future:

Even a Low-rate, Unsecured Loan Might Not Drive Demand

The DCOI-HEAL program was able to partner with a local credit union to offer a 5.5% unsecured loan for up to $10,000 in energy efficiency improvements. The loan application was streamlined and simple, however only five of the 35 pilot participants used the loan program to fund a home retrofit. While some of the other employees used cash or other loan products such as home equity as a funding source, a few did not believe that the 5.5% rate was low enough to encourage borrowing. In addition, while none of the DCOI-HEAL pilot participants encountered income-qualifying restrictions, there is the potential for a lack of financing options for income-restricted employees. The use of credit enhancements – a loan loss reserve to protect against defaults or an interest rate buy down – could provide incentives to private lenders to offer and administer lower interest loans to a broader employee base. These options are discussed in the DCOI paper “Financing Energy Efficiency – Based Carbon Offset Projects at Duke University.”

Tax Implications of an Employee Benefit Program Drive Program Costs Up

Any benefits provided to employees are potentially subject to federal and state taxes. In the DCOI-HEAL program, paying for the audits was considered supplemental income for employees, increasing their tax burden. To account for this, the DCOI adjusted the benefit in order to pay for the taxes associated and provide a true no-cost audit for pilot participants. This almost doubled the cost of each audit to the DCOI. The DCOI has explored the potential for a third party to provide these benefits to Duke employees, but this framework could still require tax payments on any employee benefits provided. The main strategy to address this challenge is to limit the monetary value of these benefits in order to minimize the cost to the employer. Another option is to require the employee to take on the tax burden, but this may significantly decrease the value of the benefit to the employee,

Energy Efficiency Programs Can be Costly to Implement and Administer

Building on the challenge of tax implications, the monetary cost to implement a program can vary greatly depending on the design of the program. The DCOI-HEAL program cost approximately $1000 per employee to implement (not taking into account program development costs). Options to reduce this cost include working with a local utility to provide the home assessment portion of the program or sharing the cost of the audit with the employee.

The DCOI is working to develop an energy efficiency education program for employees to remove many of these barriers while reducing the cost of administering the program. If you are interested in learning more or collaborating on the project, please contact Charles Adair at Charles.adair@duke.edu.

Amanda Sear is a rising sophomore at Duke University. She is interning as a Research Assistant at the Duke Carbon Offsets Initiative (DCOI) and assisting with program development and policy research. Her work supports the DCOI’s energy efficiency, urban forest, and swine waste-to-energy projects.

Everything is very open with a precise explanation of the challenges.

It was truly informative. Your site is extremely helpful.

Thanks for sharing!