What is the average household stormwater fee in North Carolina? This is a harder question to answer than you might assume. User fees for stormwater management are influenced by many factors, including a utility’s service population, the importance of managing stormwater runoff to the community, and the amount of impervious surface. The Environmental Finance Center (EFC) recently completed a statewide stormwater fee survey in North Carolina. We collected and analyzed 73 different service area fee structures. These structures paint a picture of North Carolina’s stormwater management across the state.

Most stormwater utilities in NC are managed by municipalities and contain a single fee structure applicable to the entire service area. However, several counties run stormwater utilities that have multiple fee structures depending on where the property is located in the county. For example, Mecklenburg County’s stormwater utility was created to generate revenue to manage stormwater in six different municipalities and the unincorporated area of the county. Each area provides different services and has established its own revenue needs, leading to 7 different fee structures. Person County has a separate fee structure for properties within and outside the Falls Lake Watershed. Additionally, Granville County manages stormwater in three municipalities and has differing rates for inside the Falls Lake Watershed versus outside.

Residential Stormwater Utility Fees in North Carolina

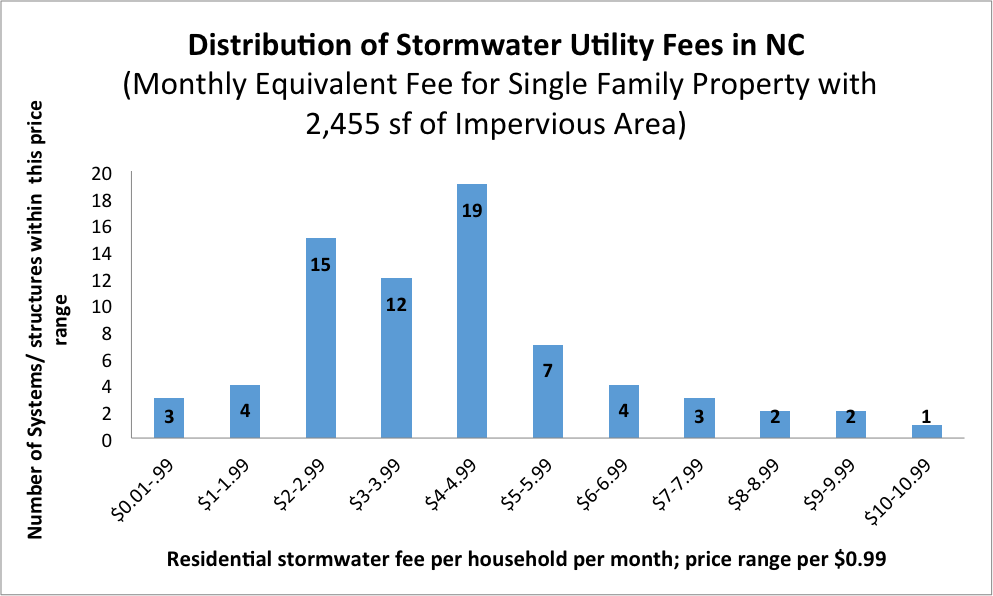

One simple way to compare fees between different municipalities and counties is to examine the representative monthly fee for a typical property. To calculate the monthly equivalent stormwater fee payment for each rate structure we collected, we assumed that the average family has 2,455 square feet of impervious surface on their property. Impervious surface area represents the area of the property that does not allow water to filter through its surface and into the soil. Commonly these are areas such roofs, driveways and walkways.

In the graph below, we show the distribution of these fees for the 73 utility rate structures. The amounts charged for a residential property with 2,455 square feet of impervious area range from $0.75 to as high as $10.18 per month.

Fee Structures Explained: Residential vs. Non-Residential Structures

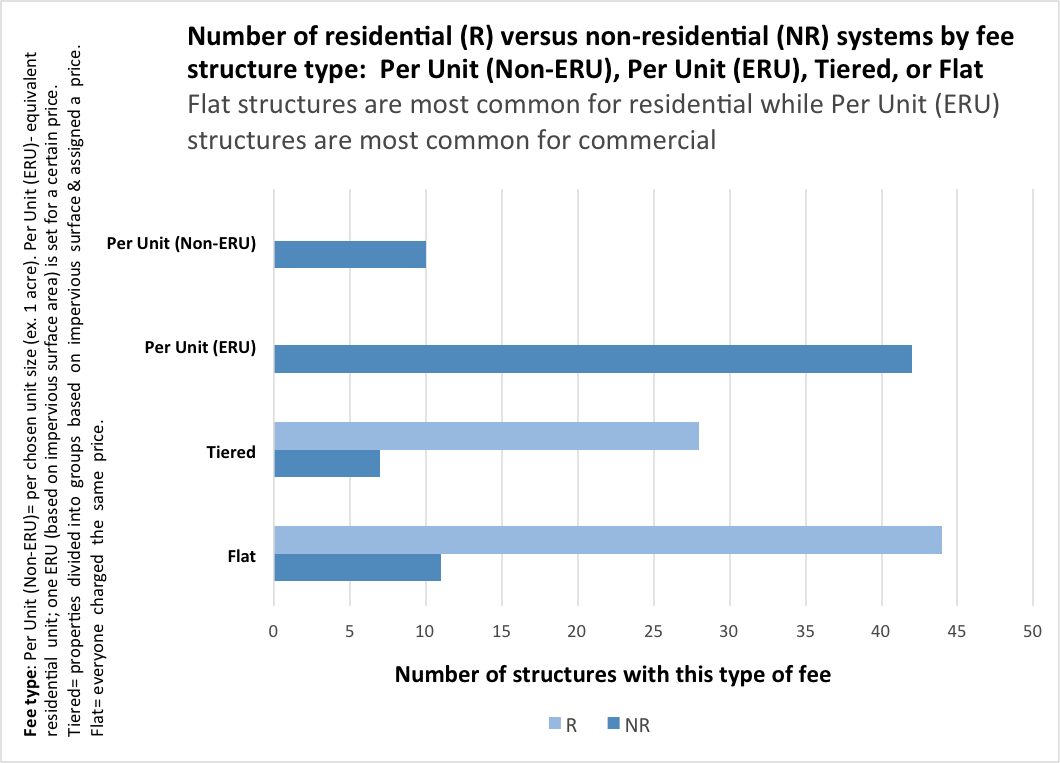

The most common residential structure consists of a “flat” fee structure where every property pays the same amount regardless of the amount of impervious surface. Forty utilities (or 54% of the utilities studied) charge a flat fee for residential customers. Some utilities employ a “tiered” structure where residential properties are divided into groups (typically 2 to 5 groups) based on the amount of impervious surface and each group pays a different fee. No utilities in North Carolina calculate the residential fee on a “Per ERU” basis. ERU stands for Equivalent Residential Unit and is a set number of square feet a utility determines from surveying properties in their customer base.

The “per ERU” structure is much more commonly used for their non-residential customers since the size of impervious surface can vary so much among non-residential properties. One ERU is typically set at the estimated impervious lot size for an average residential property. For example, a utility might establish a per ERU structure with an ERU set at a size of 2,000 square feet per month and with an ERU fee of $3 per ERU; under this structure, a property with an impervious area of 4,000 would pay $6.00. A property with an impervious area of 7,000 square feet would pay 3.5 times the ERU rate, or $10.50. The Per Unit structure is also sometimes used for non-residential properties. It is different from the Per ERU structure in that municipalities or counties with this fee structure do not base it on an equivalent residential unit, but rather a standard unit that the utility chooses. In North Carolina, the unit size most commonly chosen for commercial properties is one acre or 43, 560 square feet.

| Fee Type | Non-Residential | Residential |

| Per Unit (Non-ERU) | 10 | 0 |

| Per Unit (ERU) | 42 | 0 |

| Tiered | 7 | 28 |

| Flat | 11 | 44 |

Customer Classes and Fee Structures

Eighty-three percent of the utility fee structures studied have distinct residential and non-residential fee structures. Typically, non-residential properties end up paying more than residential properties, and they tend to be based on the use of per ERU rate structures. Since there is far less variation in property size among residential properties than non-residential properties, it may make sense for residential fees to operate on a tiered or flat fee approach. Non-residential properties vary tremendously in size and diversification of surface area, so flat fee structures are often not appropriate. A large commercial complex may end up paying the same amount as a small residential property despite having much more stormwater runoff.

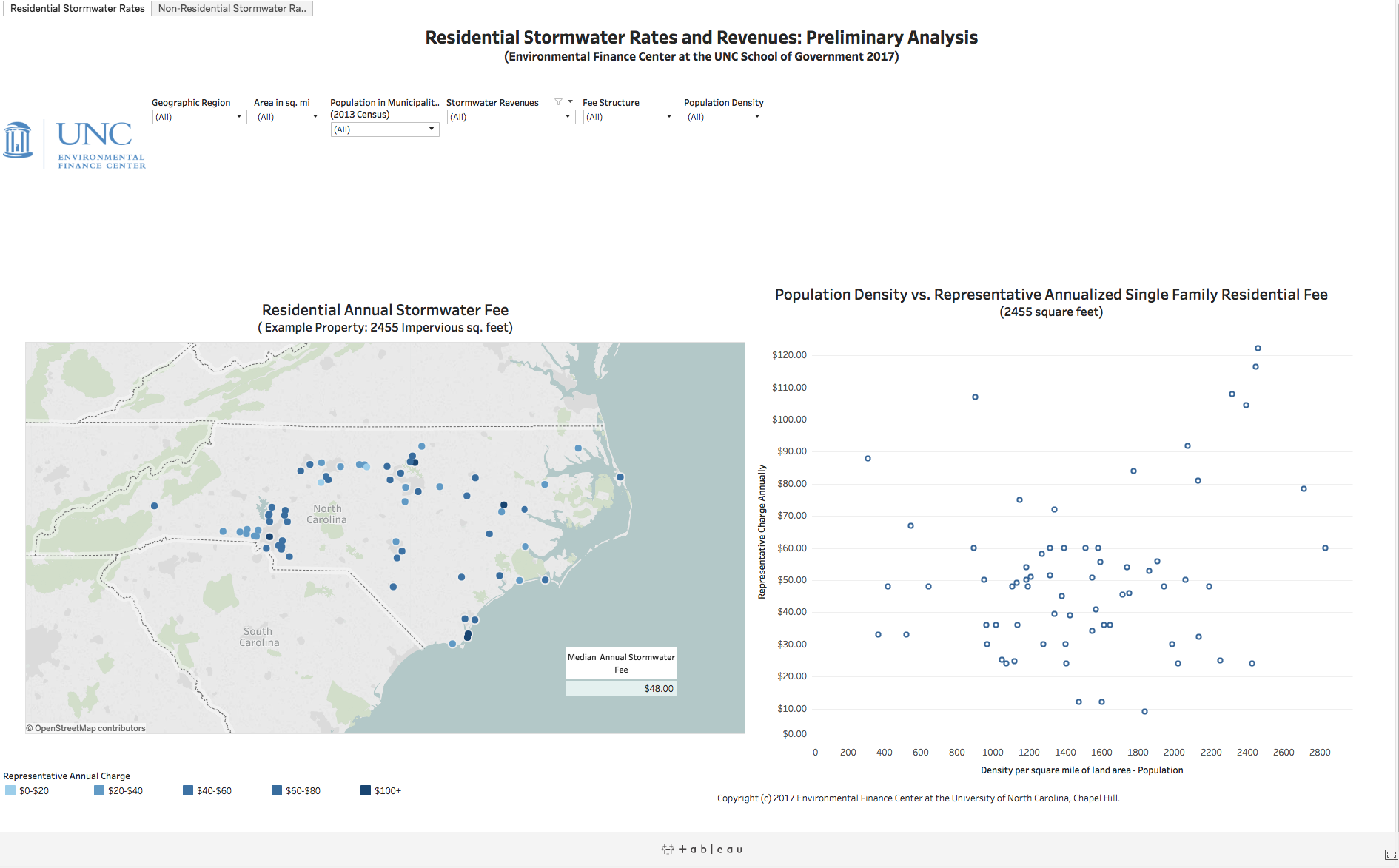

2017 North Carolina Stormwater Rates Dashboard

To learn more about stormwater rates in North Carolina, please explore our preliminary stormwater fee dashboard which visualizes rates across the state for both residential and non-residential customers.

More Information on Stormwater Rates

- The Environmental Finance Center also recently completed a survey of stormwater fees in Georgia. See a recent blog post and the Georgia Stormwater Fees Dashboard.

Tara Nattress is pursuing her Master’s of Public Administration in the School of Government at the University of North Carolina at Chapel Hill and works as a research assistant for the Environmental Finance Center.

This should be illegal to charge people for this. I was never given an option to vote for or against this. If I had the financial means I would sue to have this bill completely removed and all money collected refunded.

Yeah, good luck to you on the lawsuit. This is by far the most fair way to evenly distribute stormwater costs across a city’s population. Stormwater runoff is a serious problem in all towns and cities across the nation and it is only getting worse. Charging a nominal fee to allow a government the funding to properly manage a stormwater management systems is the best method, which is why more and more municipalities are following suit. Ignoring the problem would only lead to further problems as the infrastructure ages over time.

Lawsuits may be necessary in some cases, Chris. Given that there must be funding to address stormwater issues, I agree that the methods described above attempt to allocate the costs appropriately. But the fact that this “fee” isn’t considered a tax and can therefore be decided without a single taxpayer vote opens the door to abuse and mismanagement by local governments. The town in which a small portion of my backyard (with zero impervious surface) falls just decided to charge a flat rate of $60/year on all parcels in the town, with no exception–single family homes, empty lots, commercial and industrial. Just plain lazy, no attempt whatsoever made at “fair and equitable” or consideration of impact to the environment. When I pay a property tax of $16/year on this parcel does this $60/year seem like a nominal fee?