As the nation struggles to repair, maintain, and expand its infrastructure, public-private partnerships are gaining traction as a strategy for delivering traditionally “public” services. Public-private partnerships (or P3s) are touted on the idea that public projects can benefit from the private sector’s increased competition, more accurate pricing, expanded financing options, and more flexible personnel and procurement processes. In return, the private sector is given the opportunity to access a market otherwise served by the public. It can be a mutually beneficial relationship.

Tag: financing (Page 1 of 3)

In North Carolina, and around the country, growth in the deployment of solar photovoltaic (PV) power has accelerated dramatically in recent years. However, from the standpoint of financing the provision of electric power to customers, this growth in solar deployment presents challenges to the traditional business models of investor-owned utilities (IOUs). How will the electric power industry adapt in the coming years, especially from the standpoint of sustainable financing of clean energy?

David R. Tucker is a Project Director at the Environmental Finance Center at the University of North Carolina at Chapel Hill.

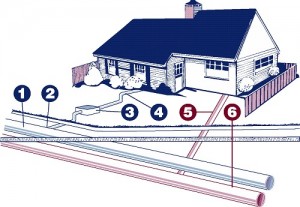

Key: 1. Water Main; 2. Water Tap; 3. Water Meter; 4. Private Plumbing (water line); 5. Private Plumbing (wastewater line); 6. Wastewater Main.

Source: City of Fort Worth, Texas

My work at the UNC Environmental Finance Center frequently centers around the study, benchmarking, and understanding of rates, especially residential rates: charges per unit across time (such as dollars per kilowatt hour for kWh of electricity used in a month; or dollars per gallon, for thousands of gallons of drinking water used in a quarter; and so on). You can see the results of our work on rates by yours truly and my colleagues in sophisticated tools that we have developed, such as our drinking water and wastewater rates dashboards, our stormwater rates dashboards, and our electric rates dashboards, among many other tools and reports that the EFC has created. Continue reading

Mary Tiger is the Chief Operating Officer of the Environmental Finance Center.

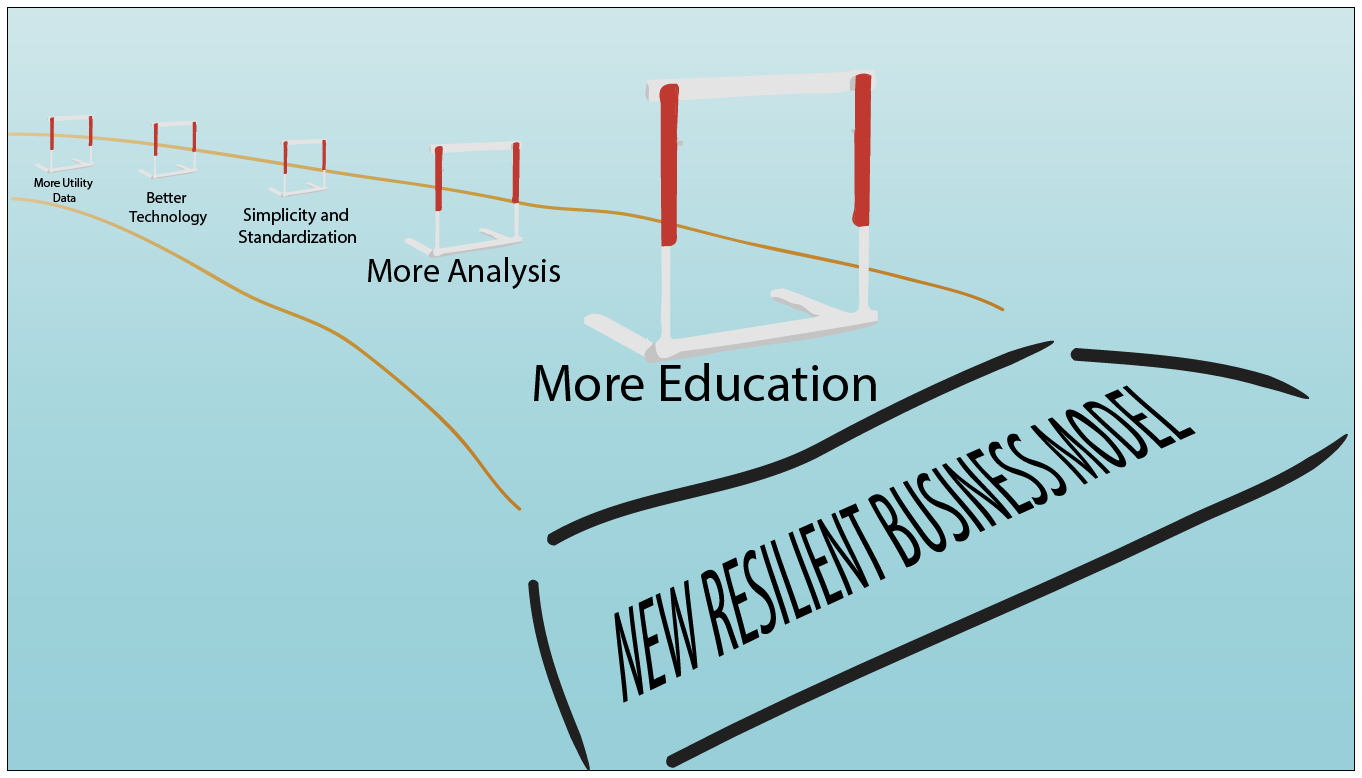

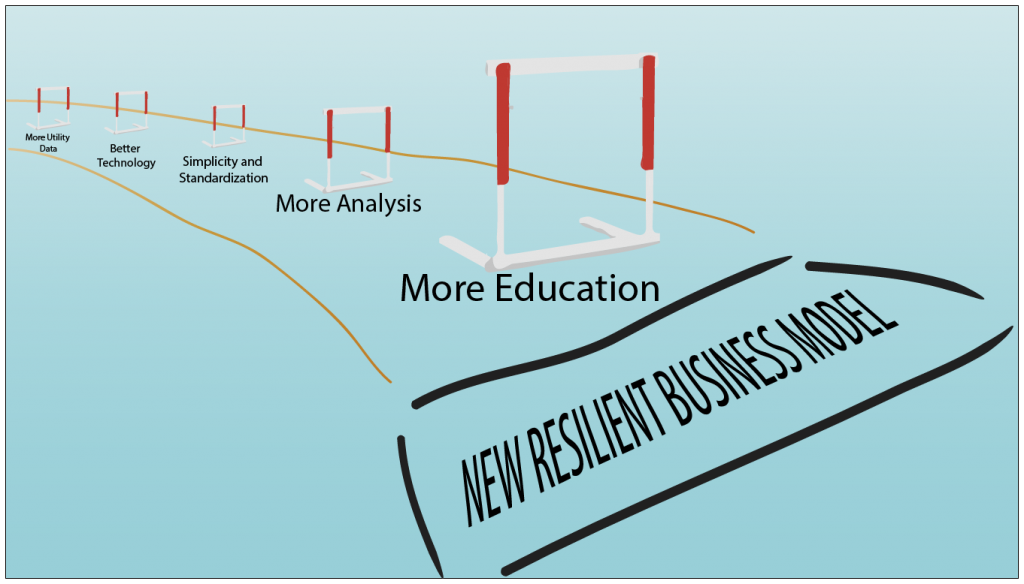

We have written about a number of alternative rate designs for water utilities on this blog in the past year (see posts on PeakSet Base Model and CustomerSelect Rate Plan). Admittedly, we have a lot of fun at the EFC thinking through creative models, linking those models to utilities’ underlying cost structures, and testing out the ramifications on utility finance, customer demand and affordability. But in practice most governing boards and utility managers are hesitant to blaze a trail, especially on an initiative that significantly alters the way revenue is earned. In a Peer2Peer virtual exchange in December, we asked eighteen utility officials what hurdles would need to be cleared before moving forward with an overhaul to their utilities’ pricing model. Their responses communicated the challenging, but not insurmountable, process of transforming a utility’s business practices.

Jen Weiss is a Finance Analyst at the Environmental Finance Center.

Quick … what do you think of when you hear the word “revolving?” A revolving door? A revolving restaurant? Perhaps a revolving credit card?

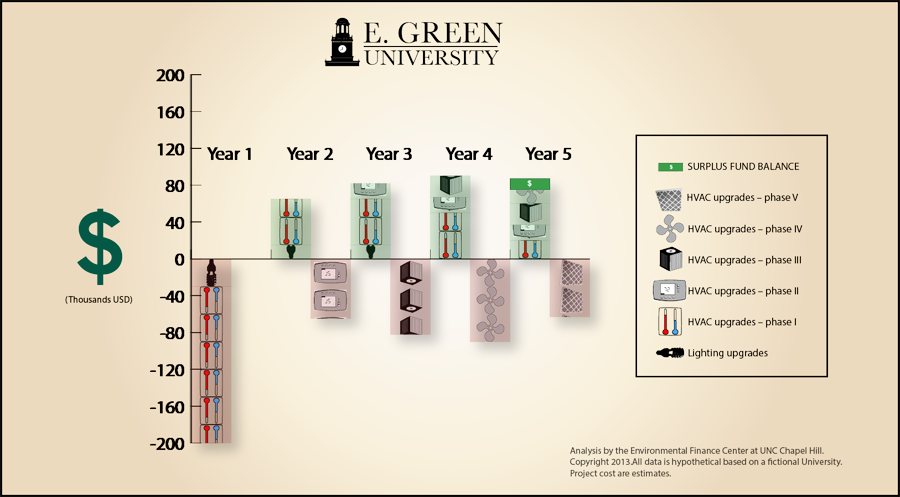

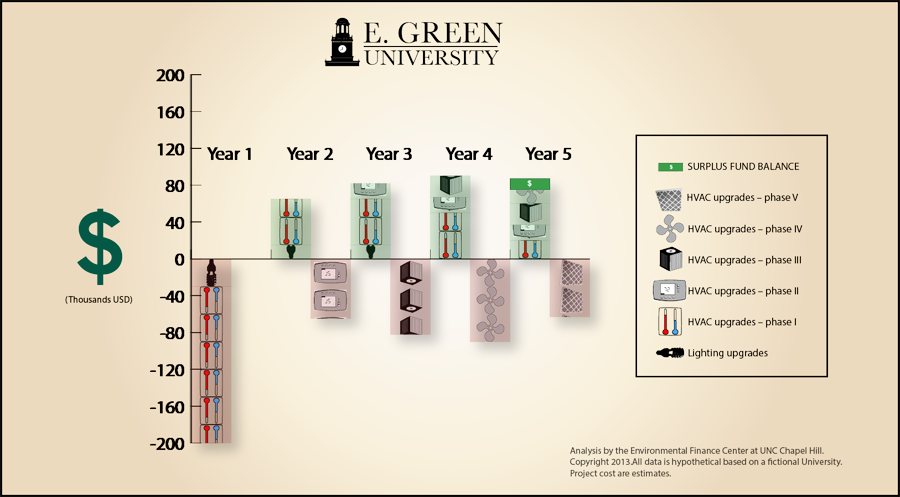

In the environmental finance world, the term “revolving” is being paired up with the equally unassuming term “green” to create an effective energy efficiency and renewable energy financing tool called a green revolving fund. At its core, it is a revolving credit instrument, operating much like a credit card which, according to Merriam-Webster, is a pretty straight forward financial tool: “a credit which may be used repeatedly up to the limit specified after partial or total repayments have been made.” But a green revolving fund is not your everyday Visa or Mastercard with a $5,000 upper limit. It is the more sophisticated older sibling of the credit card, the sibling that has grown up and gone off to college. And while it is there, it is making a significant contribution to the bottom line.